Steps to make Introductory Academic Project's Pages

Hello All,

We heartily welcome you to

blog. It seems you want help in making introductory pages of your academic

project. Well, then you have come to a right place. We will provide you - how

to make cover pages for your project.

We will go step-by-step in this.

1) Title Page:-

The first page on the academic project of any

university, whether it is GGSIPU, Delhi University, Sikkim Manipal University

(SMU), AIMA (All India Management Association) etc, is Title Page.

A sample of how to make a title page for a project is shown below:

A Report on

(Project's Full Title here)

Submitted in partial fulfillment of the

requirements

for the award of the degree of

Post Graduate Diploma in Management

(PDGM)

To

All India Management Association (AIMA),

Delhi

Project

Faculty:

Submitted by:

Faculty's name Candidate's name

Registration No:

Batch Year: 2010-2012

Program:

Year 2012 January - June B1

#24-25, 4th Floor, Andhra Association Building, Lodhi Road,

Institutional Area, New Delhi, Delhi 110003

|

| Example of How to make a first page for a project |

2) Table Of Content:-

The "Table Of

Content" contains all the information of your academic project work - page

by page. This is mainly the second page in the project work, after Title Page.

The Table of Content is

consist of 3 components: Serial Number, Topic, Page Number.

Table Of Content

S

No

|

Topic

|

Page

No

|

1

|

Acknowledgment

|

iii

|

2

|

Executive

Summary

|

iv

|

3

|

List of

Tables

|

vii

|

4

|

List of

figures

|

vii

|

5

|

Chapter-1:

Introduction

|

1

|

6

|

Chapter-2: Literature Review

|

18

|

7

|

Chapter-3: Data Presentation and Analysis

|

61

|

8

|

Chapter-4: Limitations and Conclusion

|

77

|

9

|

Bibliography

|

79

|

3) Acknowledgement:-

In a project work, the acknowledgement plays

a vital role. It states that - who has helped you during your project work, who

was your project mentor, who will check your project, who was your project

faculty. Like this, you have to sum up your acknowledgement in your academic

project work.

A sample of how to make an acknowledgement page for a project is shared below:

ACKNOWLEDGEMENT

At the completion of my

project, I would like to take this opportunity to thank all those who have

extended their support in the smooth completion of this project.

I express a deep sense of

gratitude to Project Faculty’s Name for entrusting me with the

responsibility of this project. I am extremely grateful for her constant

support and valuable advices that helped to complete this project successfully.

Finally, I thank all those who helped me directly or indirectly

during the course of my project.

Candidate’s Name

Registration

No: ________

In the above picture, you can see that,

we have red-colored a page number, which is in Roman. This is because many

universities, like AIMA (All India Management Association), goes for this

format in their project work. So, it is up to you to go like this, or consider

your project details with the university first.

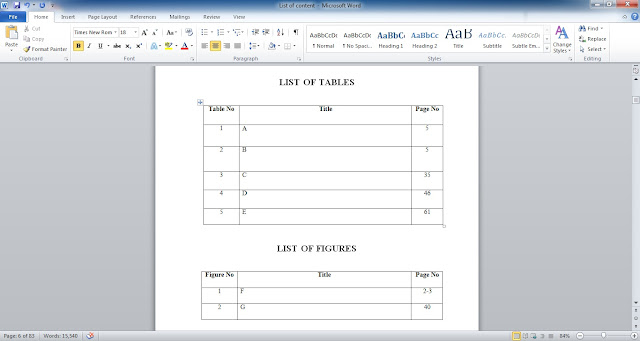

4) List Of Tables & Figures:-

The “list of table” clearly shows that how

many tables are there in your project work. Refrain from using this, if there are

no tables in your project.

A sample of how to make list of figures for an

academic project has been shared below with you:

LIST OF TABLES

Table

No

|

Title

|

Page

No

|

1

|

A

|

5

|

2

|

B

|

5

|

3

|

C

|

35

|

4

|

D

|

46

|

5

|

E

|

61

|

The “list of figures” clearly shows that how

many figures and diagrams are there in your project work. Refrain from using

this, if there are no figures in your project.

A sample of how to make list of figures for an academic project has been shared below with you:

LIST OF FIGURES

Figure

No

|

Title

|

Page

No

|

1

|

F

|

2-3

|

2

|

G

|

40

|

In the above picture, you can see that, we have red-colored a page number, which is in Roman. This is because many universities, like AIMA (All India Management Association), goes for this format in their project work. So, it is up to you to go like this, or consider your project details with the university first.

We have shared relevant pages for a academic project work with you. We can even send it to you in MS-Word format, if you want it for your academic project work, AND IT WILL BE FREE!! Kindly drop us your e-mails in the comment section, on which you require these files.

Best Of Luck..!!